Royalties: The Passive Income Gold Mine You Didn't Know You Needed

Because Who Doesn’t Love Getting Paid for Doing Absolutely Nothing?

If you’ve ever thought to yourself, “Man, I wish I could get paid every time someone plays ‘Bohemian Rhapsody’ on repeat”—good news! You can. Well, sort of. Welcome to the lucrative (and wildly underappreciated) world of royalty investing, where you can own a slice of intellectual property and get paid every time it earns money.

Royalties exist for music, books, films, patents, and even somehow for obscure mineral rights in places you’ll never visit. And unlike stocks—which require patience, market timing, and emotional discipline—royalties offer a more set-it-and-forget-it approach to wealth-building.

Why Invest in Royalties?

Here’s the deal: Royalties provide passive income, diversification from traditional markets, and in some cases, significantly better returns than your sad high-yield savings account. Plus, you get to say things like, “I own a piece of Blinding Lights,” which is objectively cooler than saying, “My 2060 target date 401k is up 2%.”

Some key benefits:

- Cash Flow Machine – Royalties pay out quarterly or monthly, meaning you don’t have to wait decades for a payout (looking at you, real estate😘 ).

- Hedge Against Market Volatility – When the stock market panics because the Fed sneezed, people will still listen to Taylor Swift, watch The Office, and drill for oil.

- Cool Factor – Try telling someone at a party you own the rights to a portion of a Drake song. It’s a flex.

How to Invest in Royalties: Platforms That Make It Easy

You don’t need to be a music mogul or a Silicon Valley patent troll to get in on the action. Here are some platforms making royalty investing accessible for as little as $1.00:

1. Tangy Market (Because what’s sweeter than passive income?)

Tangy Market lets users buy shares of music royalties and receive quarterly payouts. They have everything from Maroon 5 and Brittney Spears to David Guetta and Faaka.

The best part is that you can invest for about a dollar. Just to try it out, I bought shares in a catalog of 115 Swedish pop song. It cost me $20 plus fees. fantastisk! (this means "awesome" or "fantastic" for those of you who are not polyglots 🙄). My portfolio includes Viskar en Bon by Peter Hallstrom, Vi borjar om by Nya Vikingama, and other bangers that'll surely be on everyone's Spotify liked songs this summer.

💡 Key Feature: Buy in at IPO pricing or trade royalties on the secondary market. Think of it like Robinhood, but for music rights.

2. Musicow (Where music fans become stakeholders)

In there own words, "Musicow is a South Korean company operating a music copyright trading platform where users can buy, sell, and trade fractional ownership of music rights, aiming to revolutionize the music industry and foster a stronger connection between artists and fans". Musicow, in partnership with Jay-Z’s Roc Nation, allows fans to buy fractional shares of song copyrights. This means you get a cut every time one of your favorite songs is streamed, played on the radio, or used in a commercial.

As of the writing of this article it appears to be an "early access" sign-up so I don't have too many details to share. If you followed Jay-Z's Tidal debacle you might be wary of this one as well.

💡 Key Feature: Artists sell fractions of their royalty revenue, meaning you’re directly supporting musicians while making money. Now you can say "I'm part of the music industry", and it won't be a lie.

They have an app available on both Google Play and Apple App Store.

3. Sonomo (For those who love passive income with a monthly rhythm)

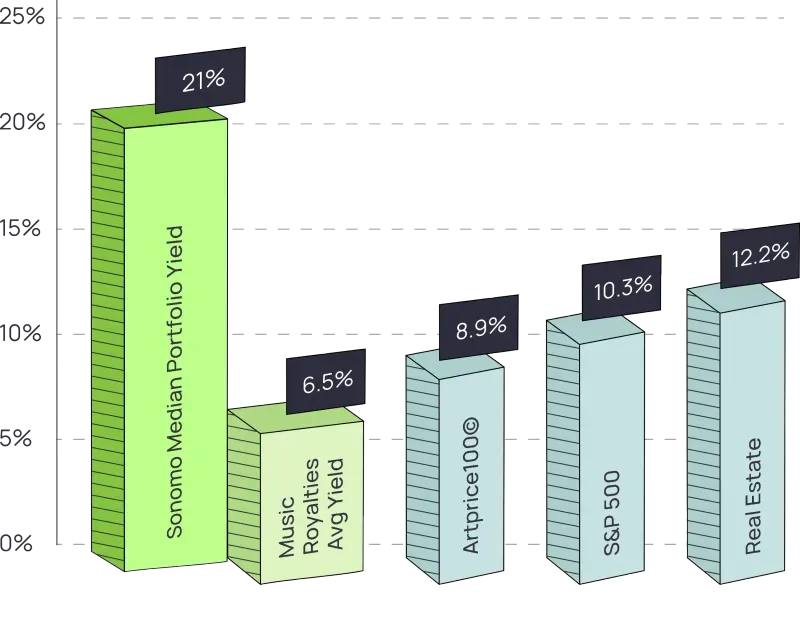

Sonomo specializes in monthly royalty payouts rather than quarterly, meaning your cash flow stays steady. They offer access to thousands of assets, helping you build a diversified portfolio of music royalties. My years building decks and presentations made me gasp in horror when I saw the graph below, but I can proudly say this was not my work, I lifted it directly from their site. (Why in the name of everything holy is the Sonomo column set back, but also bumping corners with the "Music Royalties Avg Yield!?). Also, I have no way to verify their median portfolio yield, so take it con un grano de sal. Similar to some of the other featured platforms, they offer both single song and baskets of songs with a few dozen to hundreds of individual tracks.

The site definately has one of the cleaner UI's that I've seen so they've got that going for them, which is nice.

💡 Key Feature: Broad diversification. With thousands of assets available, you can spread your investments and reduce risk, just like you should be doing with your crypto bags (don’t pretend you haven’t been all-in on one coin before).

4. Bolero (The high-end music rights marketplace)

Bolero focuses on high-value music assets and passive income generation. This is where you go if you want access to top-tier music catalogs—think The Beatles, Michael Jackson, or Queen (if you can get in early enough). They claim to target initial returns in the range of 7.5% to 20% APY. Not bad. They do offer fractional shares so it's possible to start with a modest investment and build over time. Another feature for those of you who appreciate the excitement of the crypto world is that they operate using USDC (a dollar-pegged crypto currency). This probably means that a lot of people who would otherwise use the platform will be turned off by the medium of exchange, but it will also benefit from a userbase that has accepted and use crypto.

Platform: Website

Minimum Investment: $2

💡 Key Feature: Premium music rights access. It’s like investing in blue-chip stocks, but instead of Apple or Tesla, you own part of Billie Jean.

5. Partners Group (Because music isn’t the only royalty game in town)

While most platforms focus on music, Partners Group takes a multi-sector approach, investing in royalties across various industries—including pharmaceuticals, mining, and entertainment. Unfortunately this is just barely outside of my pay range...most of us peasants won't be investing with Partners Group. They generally cater to institutional investors, family offices, and private investors with $10M + ready to drop. Buy hey, goals, amiright?

6. Royalty Exchange

Royalty Exchange is an online marketplace that allows investors to buy and sell royalty assets from various intellectual properties, primarily music, but also including film, patents, and more. This is one of the older platforms, founded in 2011, and one that I have not personally used, but I love the idea and could see adding it to the porfolio. The biggest challenge is probably that it does NOT offer fractional shares so your investment will typically be in the $10k to >$1M range.

- Asset Types: Royalty Exchange offers a wide range of royalty assets, including music, film, patents, book publishing, and more.

- Investment Terms: Assets are typically sold as either "Life of Rights" or term-based (e.g., 10-year) investments. Life of Rights assets provide royalties for the duration of the copyright, while term-based assets offer a fixed timeframe.

Dollar Age Indicator

- Definition: Dollar Age is a metric used by Royalty Exchange to assess the stability of earnings from a music catalog. It measures the time-weighted revenue produced in the last year against the age of the songs included.

- Purpose: This indicator helps investors evaluate the potential longevity of royalty earnings, regardless of the music genre or popularity.

Investment Details

- Average Returns: Music royalties on Royalty Exchange have delivered an average return of over 10%, with some assets reaching up to 17%.

- Minimum Investment: Typically starts around $1,000 but varies by auction.

- Average Investment: Ranges from $5,000 to $30,000, depending on the asset but can easily get into the millions for highly desirable catalogs or assets

- Investment Process: Investors can participate through auctions or "buy now" listings. The platform provides detailed financial data to help investors make informed decisions.

Additional Features

- All Access Membership: Offers benefits like automated investing, reduced fees, and access to private syndicate offerings for a subscription fee.

- Data and Analysis: Royalty Exchange provides comprehensive data and insights to help investors assess potential investments and manage their portfolios effectively.

Overall, Royalty Exchange provides a unique opportunity for investors to diversify their portfolios with royalty assets, offering a blend of passive income and potential long-term appreciation.

Which Type of Royalties Should You Buy?

Not all royalties are created equal. Some pay higher yields but depreciate over time (like that NFT you regret buying), while others generate consistent income for decades.

We really only covered music royalties in this article, but there are plenty of other avenues you could explore. Here are a few:

Music Royalties 🎵

- Best for: Recurring revenue from hit songs.

- Risk level: Medium. Trends change, but classics remain valuable.

- ROI potential: 5-15% annually (varies by song popularity).

TV & Film Royalties 🎬

- Best for: Cult classics and syndicated shows.

- Risk level: Low to Medium. Once a show is in syndication (looking at you, Friends), it generates revenue for decades.

- ROI potential: 4-10% annually.

Book Royalties 📚

- Best for: Popular novels and educational books.

- Risk level: Medium to High. Unless it’s a bestseller (or on every high school reading list), revenue can fluctuate.

- ROI potential: 5-12% annually.

Patent Royalties 🏭

- Best for: Tech & pharmaceuticals.

- Risk level: High. These can be cash cows (think blockbuster drugs) or duds (think Theranos).

- ROI potential: Varies wildly.

Oil & Gas Royalties ⛽

- Best for: Long-term, passive cash flow.

- Risk level: Medium. Prices fluctuate, but the demand for energy is constant.

- ROI potential: 8-20% annually.

Potential Risks & What to Watch For

Like any investment, royalties aren’t without risks. Here’s what to keep in mind:

- Copyright Expiry: Some royalties only last a certain number of years.

- Market Trends: Just because a song is a hit today doesn’t mean it’ll be streaming in 10 years (RIP to all those one-hit wonders).

- Liquidity Issues: Selling royalty shares isn’t as instant as trading stocks—you may need to wait for the right buyer.

- Regulatory Changes: Copyright laws and streaming revenue models can shift unexpectedly.

Final Thoughts: Is Royalty Investing Worth It?

Absolutely—if you do it right, but like any investment, it should fit with your risk tolerance and objectives. Investing in royalties gives you access to passive income, a hedge against inflation, and a chance to own a piece of pop culture. Whether you’re vibing with music royalties, diving into film rights, or getting into oil & gas, there’s a royalty asset class for every investor.

So next time you hear a song on the radio, a movie theme playing, or see an insanely priced textbook at the bookstore, just remember—someone is getting paid for that. That someone could be you.

TL;DR:

- 🎵 Music royalties = Own part of a song, get paid when it’s played

- 🎬 TV/Film royalties = The gift that keeps on giving (for decades)

- 📚 Book royalties = Textbooks = $$$

- ⛽ Oil & gas royalties = Long-term cash flow, energy demand is forever

- ⚠️ Risks exist, but diversification is key

So, ready to turn your investments into sweet, sweet passive income? Hit play on royalty investing and start cashing in! 💰🎶