Fractional Art Ownership: How to Own a Piece of a Picasso Without Selling a Kidney

Stocks are boring. Art isn’t.

If you’ve ever dreamed of investing in a Warhol or Basquiat—but balked at the eight-figure price tags—fractional art ownership might be your entry point into one of the oldest and most prestigious asset classes. Thanks to tech platforms and tokenization, you can now buy a slice of a museum-quality masterpiece with as little as $10.

Let’s break down how it works, who’s leading the charge, and how to play it smart.

🎡 TL;DR: Why Art?

- Cultural cachet + price appreciation = elite flex meets serious ROI.

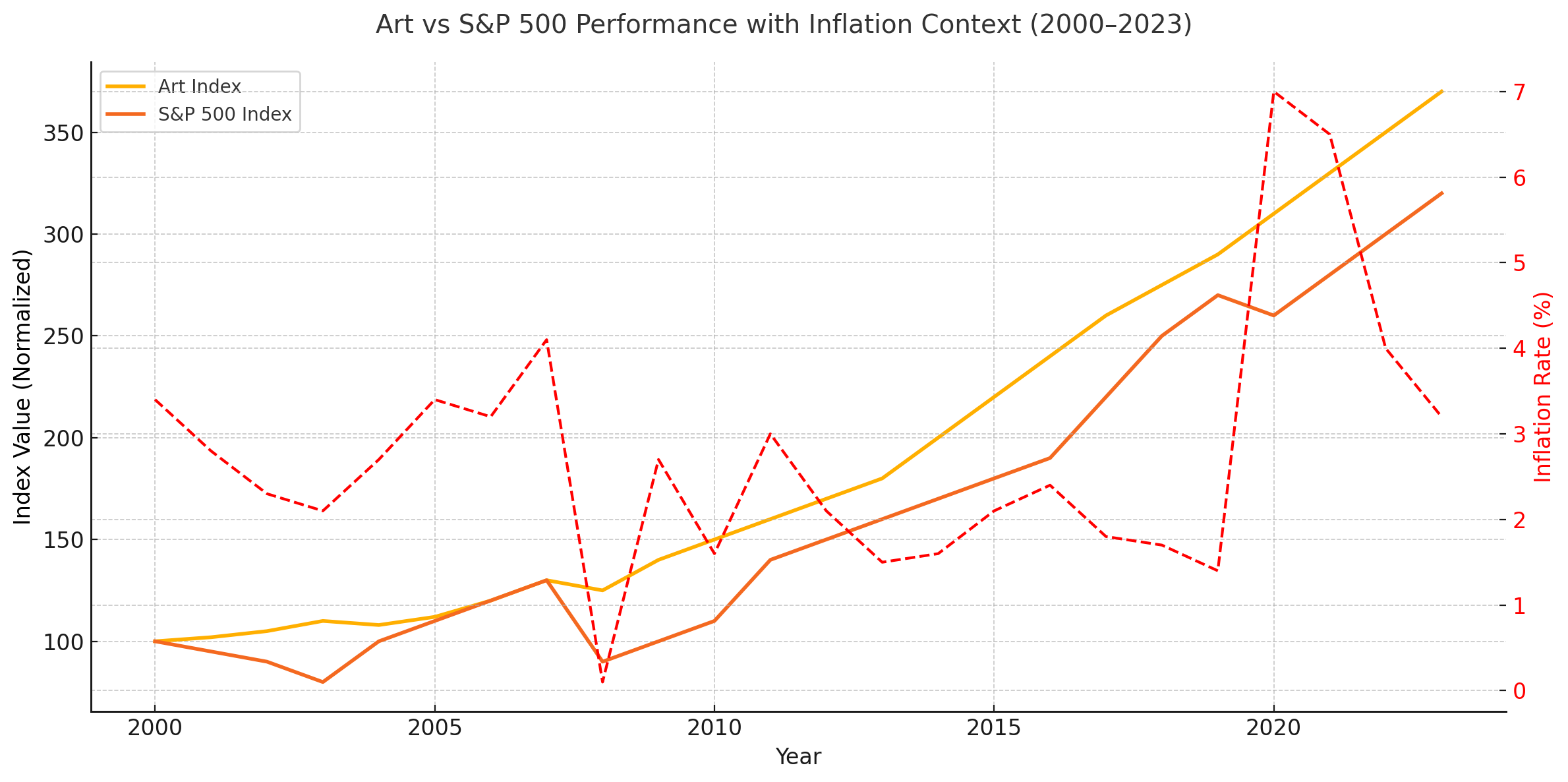

- Historically, art prices show low correlation to public markets—perfect for diversification.

- Deloitte's Art & Finance Report estimates $1.7 trillion in global art assets by 2026 (source: Deloitte Art & Finance Report 2023).

- Art outperformed the S&P 500 in multiple decades, especially during periods of inflation and market stress.

🎯 Masterworks: The OG of Art Fractionalization

Masterworks is one of the longest-running and most established fractional art investment platform, founded in 2017. It specializes in blue-chip contemporary artworks from artists like Banksy, Basquiat, and Picasso. Unlike blockchain-native platforms, Masterworks operates under SEC-qualified offerings, making it a traditional but highly trusted player in the space. Anyone can invest with a minimum of around $500, and the platform has completed over 16 exits to date, reporting strong historical returns. Liquidity remains limited, but the simplicity and compliance make it a solid starting point for new investors in the space.

What it is: A blue-chip art investment platform letting you buy shares in multi-million dollar artworks (think Banksy, Basquiat, Picasso).

- Minimum: ~$500.

- How it works: Masterworks buys the art, securitizes it via an SEC-qualified offering, and sells shares. They later sell the artwork and distribute profits.

- Track record: 16+ exits, with reported IRRs of 13.9%+ and $61,357,243 distributed back to investors.

- Upside: Access to high-end pieces typically reserved for the ultra-wealthy.

- Downside: 10+ year hold periods are common, and liquidity is limited.

Masterworks is basically the Vanguard of fine art—with a splash of Sotheby’s attitude. This is a platform that I have personally used and found it to be fairly simple. As noted above, the biggest challenge is liquidity. If you are going to invest in art you do need to be prepared for the long-haul. It can take weeks or months to sell your shares if you decide you want to liquidate.

🖼️ Artemundi: Blockchain Meets Blue-Chip Art (UPDATED)

Note: when I first published this article I had mistakenly written that Artemundi was only available to institutional and HNWIs. A few team members from Artemundi politely corrected me that Artemundi offers fractional ownership to retail investors! I have since updated this section. Also to note, Artemundi is also one of earliest (if not THE earliest) art investment platforms with a founding in 1989.

- What sets it apart: One of the earliest to use blockchain for high-end art ownership. Artemundi and Sygnum Bank pioneered the fractionalization of art ownership, allowing investors to own shares of high-value artworks, like a Picasso, through Art Security Tokens (AST). If you've followed my other content you would know that I am a huge proponent of crypto and blockchain and I wouldn't be surprised to see more investments moved from outdated mainframe ledgers to public blockchains.

- Notable feat: Fractionalized Picasso’s Fillette au Béret. Artemundi’s pieces often make it into museum exhibitions, adding prestige and valuation upside.

- Investor type: Fractional art ownership for as low as €5o (only available in Europe); institutional, and HNWI

- Focus: Museum-quality pieces only.

- Credibility: Over $1 billion in art managed.

🛡 Particle: Tokenize Your Taste

Particle launched in 2021 as a next-gen art platform built on blockchain. It focuses on iconic, high-value contemporary artworks—like Banksy’s Love is in the Air—which are split into 10,000 NFT “particles.” Unlike traditional platforms, Particle emphasizes decentralized governance and retail accessibility, offering Web3-native exposure to museum-quality art. I think we are starting to see a theme here...Investments are moving to the blockchain!

- Minimum: $1,500.

- Model: Each artwork is split into 10,000 “particles” (NFTs) stored on-chain.

- Web3 twist: Tokens are tradeable and tied to a decentralized community governance model.

- Investor Access: Open to all investors—not limited to accredited participants

Best for Web3-native investors who want exposure to culture-backed NFTs with real-world provenance. The currency used is USDC (one of the most popular USD pegged stablecoins). Unlike Artemundi, this is one for those of us existing a shade above poverty.

Yieldstreet: Art Funds With a Theme

Yieldstreet launched its art investment vertical in 2020, building on its broader alternative asset platform that includes real estate, legal finance, and structured notes. What sets Yieldstreet apart is its fund-based model—offering exposure to collections of thematically curated artworks (such as pieces from the Harlem Renaissance or overlooked global creators), rather than individual works. The platform is designed for accredited investors seeking long-term, passive exposure to fine art, backed by a regulated fund structure and professional curation. They boast partners like Goldman, Deloitte, and Carlyle (my ex-CFGI colleagues will sympathize with being a part of the Carlyle PE umbrella).

I checked their site and although art is listed under their investments, they don't currently have a fund dedicated to this category.

- Minimum: $10,000.

- Target: Accredited investors.

- Model: Longer-term fund structure with semi-liquid investment windows.

- Edge: Diversification within the art fund itself; great for hands-off investors.

Pro move: Layer this with Yieldstreet’s other alternatives (real estate, credit) for holistic exposure.

Mintus: High-End, UK-Regulated Art Plays

Mintus is a London-based fractional art platform launched in 2021 that focuses on high-value, investment-grade artworks from globally recognized artists like Andy Warhol and Damien Hirst. It’s geared toward institutional and accredited investors looking for UK-regulated access to fine art. Mintus stands out for its rigorous selection process, focus on liquidity windows, and compliance with FCA standards.

- HQ: London.

- Minimum: ~$3,000.

- Target: Institutional + HNWIs😞).

- Focus: Established artists like Warhol, Hirst, Basquiat, Richter, and van Gogh.

- Compliance: FCA regulated.

Think of Mintus as the Art Basel of investment platforms—sharp, refined, selective. Another one that I probably won't be able to use anytime soon, but if you put caviar on your toast this could be an option for you.

Rally: Robinhood-Style Art Investing

Rally is the most accessible and culture-driven of the fractional platforms, starting at just $10. While it began with classic cars, it has since expanded into iconic collectibles like OG Batman comics, Gary Vee's original doodles, Elvis Presley concert tickets, sneakers, sports memorabilia—and yes, fine art too. What makes Rally different is its mobile-first design and active secondary trading window, making it feel more like Robinhood meets Sotheby’s. It’s built for everyday investors who want a piece of culturally significant assets, not just million-dollar canvases.

- Minimum: $10.

- Origin: Started with classic cars, now expanded into fine art.

- Model: Securitized offerings through a mobile-first app.

- Edge: Active secondary market + ultra-low barrier to entry

- Who can invest: Anyone (U.S. investors, no accreditation required)

- Assets: Classic cars, comics, concert memorabilia, sneakers, art

This is the Gen Z entry point into fractional art—with meme coin energy but tangible assets. I don't have an account yet, but out of all of these, this one is the most appealing to me.

Artex: Blockchain-Powered, Globally Diversified

Artex is a blockchain-native platform (DJ Khalid voice "Another one!") launched to democratize art investing at a global scale. It specializes in tokenized shares of fine art by international artists, with an emphasis on diverse genres and underrepresented markets. Unlike traditional players, Artex focuses on liquidity and transparency through decentralized infrastructure, making it a true DeFi-native mutual fund for fine art. While still maturing in terms of market reach, its tech-forward design and global vision make it one to watch for investors seeking exposure outside the Western art canon.

- What it is: Tokenized art investment platform focused on international artists and diverse styles.

- Tech stack: Blockchain-based for secure, transparent ownership.

- Thesis: Broader cultural lens → undervalued alpha.

If Particle is the Web3 flex, Artex is the DeFi-native mutual fund of global art.

📊 Platform Comparison

| Platform | Min Investment | Focus | Liquidity | Regulation | Edge |

|---|---|---|---|---|---|

| Masterworks | $500 | Blue-chip modern art | Low | SEC | Most established |

| Artemundi | Accredited | Museum-grade classics | Very Low | Institutional | Blockchain + museums |

| Particle | $1,500 | Tokenized art (NFT) | Moderate | Decentralized | Web3-native |

| Yieldstreet | $10,000 | Art equity funds | Medium | Regulated | Thematic investing |

| Mintus | $3,000 | UK fine art | Medium | FCA | Institutional polish |

| Rally | $10 | Art + collectibles | High | SEC | Easy secondary trading |

| Konvi | €250 | Art + watches/wine | Medium | EU | Broad luxury exposure |

| Artex | Varies | Global + blockchain art | Varies | TBD | Diverse + DeFi infra |

🔥 Final Thoughts: Should You Buy Art Shares?

Yes, if:

- You want cultural alpha + real diversification.

- You're okay with longer time horizons.

- You’re already maxed on stocks and crypto.

No, if:

- You need daily liquidity.

- You don’t understand the market or the artist.

- You chase hype over fundamentals.

🧠 Pro Tips for Fractional Art Investors

- Treat art like VC: 1–2 exits could make the whole portfolio.

- Invest in what you understand: Follow artists and movements that resonate.

- Use multiple platforms: Diversify across themes, tech models, and liquidity profiles.

- Watch for secondary markets: They’re key to real ROI on fractional assets.